What Is Zombie Debt, Really?

If you’re a debt collection agency trying to stay compliant and competitive in 2025, you’ve likely heard the term “zombie debt.” It sounds dramatic but it’s a very real risk for third-party debt collectors.

Zombie debt (aka time-barred debt) is old debt that’s beyond the statute of limitations for legal action. In other words: you can’t sue to collect it, but that doesn’t mean it’s gone.

In fact, according to the Consumer Financial Protection Bureau (CFPB), debt buyers often purchase time-barred debts for pennies on the dollar—then chase down consumers who may not even know their legal rights.

But here’s the catch: one wrong move, and your agency could face serious FDCPA or state law violations.

Let’s break down what you can (and can’t) do as a collector and how modern debt collection software helps protect your business from becoming a headline.

Can You Legally Collect on Zombie Debt?

Yes—But Only Within Very Clear Boundaries

Zombie debt isn’t “uncollectible.” It just means the legal action window has closed. That means:

- ✅ You can attempt to collect voluntarily

- ❌ You can’t sue, threaten a lawsuit, or imply legal consequences

- ❌ You can’t re-age the debt by tricking someone into making a small payment

Under the Fair Debt Collection Practices Act (FDCPA), misrepresenting the age or legal status of a debt is illegal. That includes hinting that a consumer could be sued, garnished, or reported to credit bureaus for time-barred debt when you know you can’t.

Agencies that do this are often labeled “zombie debt collectors”—a nickname that’s been tied to FTC enforcement actions, consumer watchdog exposés, and viral personal finance horror stories.

How the Statute of Limitations Works

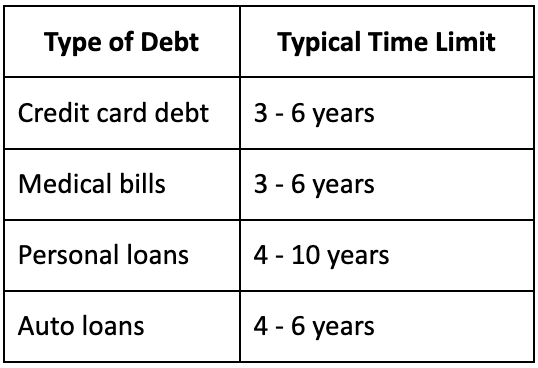

Each state sets its own statute of limitations based on the type of debt. Here are some rough averages:

⚠️But beware: state laws vary widely—and so do interpretations of what restarts the clock. Take a look at the CFPB’s guidance.

A small payment, email acknowledgment, or even a phone conversation can reset the statute in some states. That’s why many agencies only touch zombie debt if their software tracks account age, state-specific rules, and debtor location—automatically.

What the Law Requires You to Say (and Not Say)

Disclosures That Matter

Some states require specific written notices if you’re collecting on time-barred debt. These are often part of a validation notice or debt validation letter—which must state that:

- The debt is too old for a lawsuit

- Payment is not required and will not revive the debt

- The debtor is not required to acknowledge the debt

Failing to include these disclosures can violate both federal law and state attorney general guidance.

Other best practices include:

- Avoiding misleading phrases like “settled debts” or “we can resolve this today”

- Never threatening to report old debt to Experian, Equifax, or TransUnion

- Providing clear opt-out options for communication

Modern agencies are even sending validation notices by email or SMS, with links to digital PDFs or secure portals—cutting down on postage costs while staying compliant.

Learn more: Best Debt Collection Software for 2025 | Aktos

How Zombie Debt Impacts Credit Reports (or Doesn’t)

Zombie debt cannot legally be reported to credit bureaus if it’s beyond the 7-year reporting window under the Fair Credit Reporting Act (FCRA).

Trying to sneak a time-barred account back onto someone’s credit report is not only unethical—it’s grounds for lawsuits, CFPB fines, and losing original creditor trust.

If a consumer disputes the account and it’s found to be too old, debt collectors must delete it from the bureau records immediately.

Agencies using platforms like Aktos can automate these safeguards. Flagging accounts that should never be reported and suppressing communications that could revive unpaid debts accidentally.

What Happens If You Get It Wrong

Zombie debt lawsuits are often low-hanging fruit for regulators. The Federal Trade Commission (FTC) and CFPB have recovered billions in consumer damages from collection agencies that violated time-barred debt rules.

Consequences can include:

- Hefty fines from federal and state AGs

- Class action lawsuits

- Consumer reviews labeling your agency a scammer

- Termination of client contracts

Even worse? You may never see the credit card or lender placements again if your compliance reputation tanks.

How to Collect Zombie Debt Without the Risk

Use Software That Flags Time-Barred Accounts Automatically

Legacy platforms? They won’t cut it. You need real-time compliance tools that:

- Apply state-by-state rules based on consumer location

- Track last activity dates and statute expiration

- Suppress risky accounts from autodialers or AI phone agents

- Auto-generate compliant validation notices

- Prevent collectors from accidentally sending wrong disclosures

Aktos does this natively—no bolt-ons or spreadsheets required. Our clients reduce legal exposure, avoid debt scavenger reputations, and streamline multi-state outreach.

Learn more: Best Collection Agency Software for Growing Teams | Boost Debt Recovery & Automate Workflows

Best Practices for Handling Old Debts in 2025

1. Train Your Agents on State Laws

Don’t assume your team knows the difference between a time-barred account and one that’s just stale. Regular training = fewer mistakes.

2. Don’t Contact Consumers Without Valid Addresses

If you can’t prove they received a notice, you risk being accused of harassment (even with a certified letter).

3. Never Threaten Legal Action Unless You Can Actually Follow Through

That includes vague threats like “next steps” or “further action may be taken.” These are classic FDCPA red flags.

4. Log Every Contact Attempt for Audit Trails

If your team uses AI or omnichannel outreach, you need timestamped records that show compliance with federal and state law.

5. Ask Your Clients for Accurate Account Age

Zombie debt problems often begin with poor placement data. Make it part of your debt validation process.

Final Thoughts: You Can Collect Zombie Debt—But Should You?

Time-barred debt doesn’t have to be deadweight. With the right strategy, software, and disclosures, you can collect responsibly without putting your agency or clients at risk.

But if you’re relying on clunky tools or outdated debt collection software, you’re already behind. Modern compliance demands automation, real-time rule enforcement, and seamless state-by-state logic.

If your team is chasing zombie debt with 2005 technology, it’s only a matter of time before the law bites back.

Want to avoid that? Book a demo with Aktos and see how our platform keeps you compliant—and in control.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Debt collection agencies should consult with legal counsel to ensure compliance with all applicable federal and state regulations.